Remember when investing in something big—a piece of prime real estate, a rare blue-chip stock, or even a vintage bottle of wine—felt like a club with a velvet rope? The door was shut unless you had serious capital. Well, that rope has been cut. Honestly, it’s been tossed aside entirely.

We’re living through a quiet revolution in finance. It’s the rise of fractional ownership and micro-investing platforms, and it’s fundamentally changing who gets to play the game. It’s not just about stocks anymore. We’re talking art, sports memorabilia, commercial buildings, and startups. The barrier to entry isn’t thousands of dollars. It’s often just… your spare change.

What Exactly Are We Talking About Here?

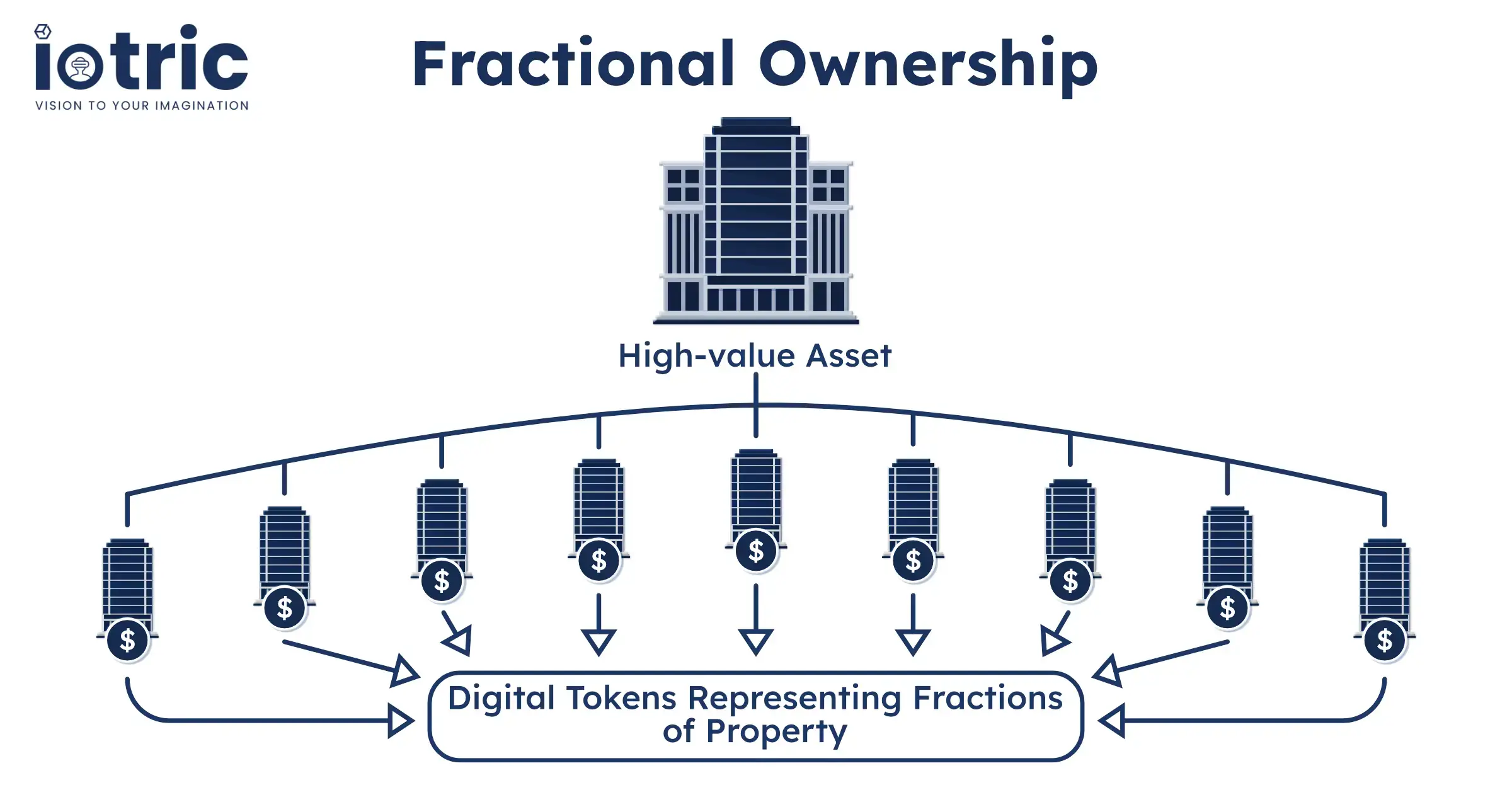

Let’s break it down simply. Fractional ownership is exactly what it sounds like: splitting the ownership of an asset into smaller, more affordable shares. Think of it like going in on a pizza with friends. You don’t need to buy the whole pie to get a few slices you really want.

Micro-investing platforms are the digital tools that make this splitting not just possible, but effortless. They handle all the messy legal and custodial stuff in the background, presenting you with a clean app where you can browse, buy, and sell your slices of the pie. The goal? To make alternative asset investing accessible to everyday people.

The Engine Behind the Explosion: Why Now?

This shift didn’t happen in a vacuum. A few powerful currents converged to create this perfect wave.

1. The Tech Enabler (Blockchain & Regulation A+)

Advanced technology, particularly blockchain, provides the transparent, secure ledger needed to track who owns what fraction of a Picasso. Couple that with regulatory changes like the SEC’s Regulation A+, which eased rules for smaller public offerings, and you’ve got a legal pathway for these platforms to operate.

2. The Cultural Shift

Millennials and Gen Z don’t just want to own things; they want experiences and stories. Owning a piece of a iconic sports franchise or a trending sneaker collection? That’s a story. Plus, there’s a deep-seated frustration with traditional investment returns and a hunger for more tangible, passion-aligned portfolios.

3. The Liquidity Illusion (and Reality)

Traditionally, if you owned a building, selling your share was a nightmare. Many new platforms offer secondary markets—think of them like mini stock exchanges for your fractions. It’s not always instant, sure, but it creates a path to liquidity for illiquid assets, which is a huge mental shift for investors.

The Landscape: From Stocks to Sneakers

The variety is staggering. Here’s a quick, non-exhaustive map of the territory:

| Asset Class | Example Platforms | The Appeal |

| Real Estate | Fundrise, Arrived Homes | Access to commercial/residential property without being a landlord. |

| Art & Collectibles | Masterworks, Rally | Ownership in blue-chip art or pop culture items (comics, cars, cards). |

| Startups & Venture | SeedInvest, StartEngine | Angel investing without needing a million-dollar network. |

| Public Stocks (ETFs) | Public, SoFi Invest | Buy fractions of any stock, not just whole shares. |

| Sports & Music | Collectable, Otis | Invest in the jersey from a historic game or a rare vinyl collection. |

It’s Not All Confetti and Gains: The Real Trade-Offs

Look, the hype is real, but so are the caveats. This isn’t a savings account. Let’s be clear about the potential downsides of fractional investment platforms.

- Fees Can Eat You Up: Management fees, transaction fees, carried interest… they stack up. On a small investment, fees can take a significant bite out of any returns, or amplify losses.

- Liquidity Isn’t Guaranteed: That secondary market? It might be thin. You could be stuck holding your slice for longer than you’d like, waiting for a buyer at your price.

- You Own a Slice, Not the Keys: This is crucial. You own a financial interest in the asset’s value. You can’t hang the painting in your living room on Tuesdays. The emotional utility is different.

- Valuation Volatility: How do you value a fraction of a rare Pokémon card? It’s often more art than science, and prices on secondary markets can swing based on sentiment, not just fundamentals.

A Human Way to Think About Your First Fraction

So, should you dive in? Here’s a thought. Don’t think of this as your core retirement strategy—at least not yet. Think of it as the “explore” part of your portfolio.

Start with money you’re truly okay with not touching for years. Maybe it’s that fund you’d otherwise use for a fancy gadget. Then, invest in what you understand and genuinely find interesting. Are you a architecture buff? Look at REITs or real estate platforms. Obsessed with modern art? You know where to look. This passion-based investing approach makes you a more engaged, and perhaps even a more patient, investor.

And do your homework—not just on the asset, but on the platform itself. How do they make money? What are their fees? How active is their secondary market? Read the fine print. It’s boring, but it’s everything.

The Bigger Picture: A Democratized Future?

Stepping back, this trend feels bigger than just new apps. It’s a re-imagining of capital formation and ownership. It challenges the old, centralized gates of finance. It allows for a more diversified, personal, and yes, fun, relationship with what we own.

But it also raises questions. If everything is fractionalized and traded, does that change the fundamental nature of owning something? Does it further financialize every aspect of our culture? There’s no easy answer.

That said, the genie is out of the bottle. The rise of fractional ownership and micro-investing isn’t a fad; it’s an evolution. It’s making the exclusive world of asset ownership feel a little less like a private club and a little more like a community potluck—where everyone can bring a dish, and everyone gets a taste.